News from AWB

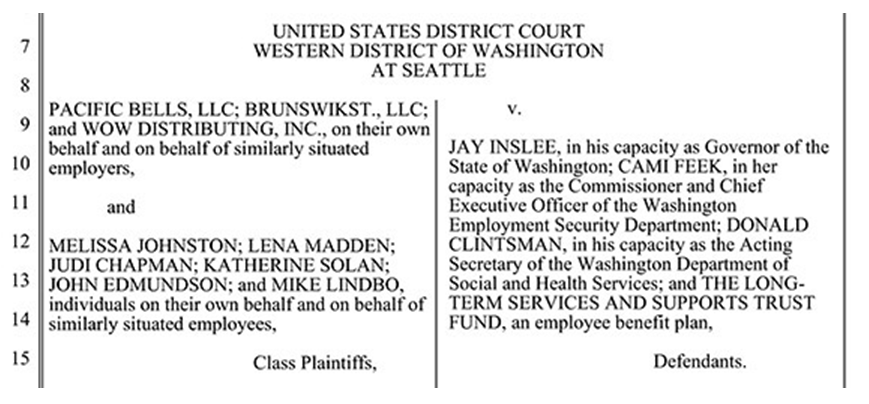

Class action lawsuit filed against new WA long-term care tax

A lawsuit filed in federal court last week challenges Washington’s new mandatory payroll tax and seeks to stop the January implementation of the 0.58% payroll premium.

The suit was filed by three businesses and six individuals. They list a variety of problems with the plan, including a federal law banning states from requiring workers to join a plan providing sickness or medical benefits. They also note the disparate treatment of people living outside Washington but working here, who pay into the program but won’t receive benefits. This also applies to people who move out of state after retirement. The filing also cites people working now but who will retire within 10 years, who also would not receive benefits.

“The state simply does not have the power to mandate an employee benefit,” said Richard Birmingham, a partner at Davis Wright Tremaine LLP.

Also last week, the state of Idaho sent a cease and desist letter, demanding Washington state not collect the tax from Idaho residents who work across the border.

There is also a citizen initiative aimed at overturning the law. Initiative 1436 would make the long-term care program and tax optional, rather than automatic and mandatory. KING 5 News has more.

How much will you pay into the WA Cares Fund? The Seattle Times has a new online calculator that estimates your lifetime contributions.

Contact AWB’s Amy Anderson or Bob Battles to learn more and get involved