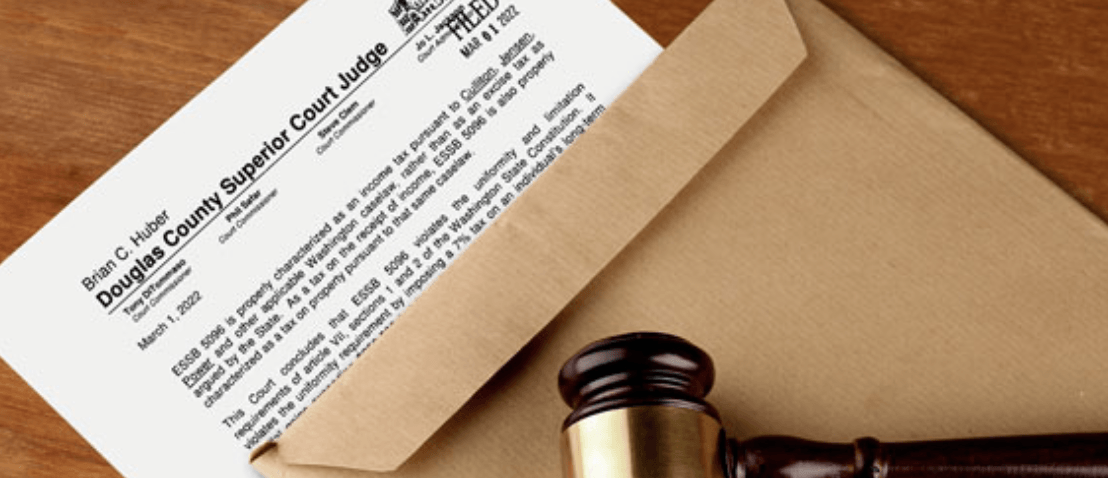

Judge strikes down capital gains tax, calling it an unconstitutional income tax

Article from AWB

A superior court judge threw out Washington’s capital gains tax last week, saying the capital gains tax runs afoul of the state constitution’s requirements that taxes be

uniform.

“It violates the uniformity requirement by imposing a 7% tax on an individual’s long-term capital gains exceeding $250,000,” Douglas County Superior Court Judge Brian Huber wrote, but imposes “zero tax on capital gains below that $250,000 threshold.”

He wrote that the state’s 2021 law “is properly characterized as an income tax… rather than as an excise tax as argued by the State.”

The case is expected to end up before the Washington Supreme Court.

Employers across the spectrum have opposed the tax which will “remove a meaningful attraction and retention mechanism” for startups and “harm our competitiveness,” according to a letter by the Washington Technology Industry Association, for example.

The Washington Research Council looks at the potential impact to state government if the tax is tossed out.

Contact Government Affairs Director Tommy Gantz to learn more and get involved.